Per the Federal Trade Commission (FTC), this type of loan works by letting homeowners convert a portion of their house's equity into cash without having to sell their home or make regular monthly mortgage payments1.

Dissimilar from your traditional forward mortgage, where the borrower must begin repaying the loan right away, borrowers do not need to pay off money received through a HECM until after the last borrower no longer lives in the home2. There are no monthly mortgage payments required1.

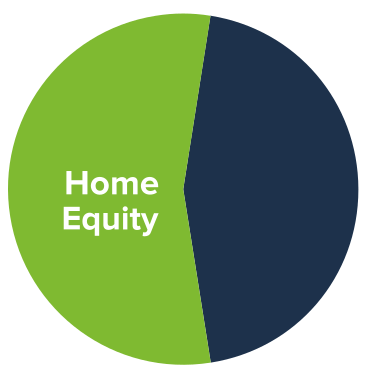

For many seniors, their home is their largest asset and the one which they have invested the most money in throughout their lives. In fact, home equity now accounts for more than 66% of total wealth for the average senior couple in America3.

Reverse mortgages in New Hampshire work by allowing homeowners to access their house's equity while continuing to reside in their house well into their retirement years. Over 1.2 million American seniors have already made a HECM loan a component of their retirement plan4.

Reverse vs. Traditional Mortgage

Reverse vs. Traditional Mortgage

When it comes to traditional and reverse mortgages, there are several similarities and differences. While classic mortgages require homeowners to make consistent payments on their loan balance every month for many years, reverse mortgages don't require borrowers to make any monthly loan payments1.

Similarities:

- Both mortgages are secured by deeds and notes.

- Closing costs for a HECM are comparable to those for a traditional (forward) mortgage.

- The owner is responsible for insurance, property taxes, and maintenance.

- The owner maintains title and ownership of the home.

Differences:

- Borrowers will never be asked to repay more than their house is worth (non-recourse loan) and they pay a moderate FHA insurance premium for this protection.

- HECM loans don't require monthly mortgage payments to be made1.

- The borrower is required to be 62 years of age or older in order to apply for a Home Equity Conversion Mortgage.

- The credit line for a Home Equity Conversion Mortgage can never be reduced; it's guaranteed to increase over the life of the loan, regardless of loan balance or home value.

Per the Federal Housing Administration (FHA) regulations, there are more elements regarding how a Home Equity Conversion Mortgage works.

Homeowners need to use the house as their main residence while maintaining the home in good condition. Homeowners taking out a HECM loan are also required to partake in independent FHA-approved counseling as part of the loan process.

How Can You Use Reverse Mortgage Cash?

How Can You Use Reverse Mortgage Cash?

The proceeds you get from a reverse mortgage can be utilized for anything you wish. Longbridge has many methods of receiving funds and how you decide to use the funds depends completely on your retirement goals and personal financial situation. If you have an existing mortgage or lien on your house in Auburn, the cash from the Home Equity Conversion Mortgage will first be used to repay the loan. The remaining funds can then be received in any of the following ways:

- A single payment, income tax-free.5

- Steady, tax-free monthly payments.5

- A line of credit, as a “safety net” for future use if or when you need it.

- Any combination of these methods.

Each borrower is different, and our clients have found creative ways to use a Home Equity Conversion Mortgage to improve their incomes, lifestyles, and monthly cash flow. Here are a few quick illustrations of how Home Equity Conversion Mortgages can work to your benefit:

- Have more cash available to pay for everyday expenses and bills.

- Reduce or eliminate debt or credit card balances.

- Help cover medical bills, which can make "aging in place" easier.

- Assist a grandchild or child with life expenses, like college tuition or a down payment on a home.

- Decrease your taxable income: avoid making taxable withdrawals from IRA, 401(k), or other retirement plans by replacing the money with income tax-free HECM funds5.

- Make repairs, updates, or improvements to your house to live more comfortably.

- Have a line of credit for occasional expenses or emergencies.

- Set aside cash to help pay for long-term care in the years ahead.

Can My Children Keep my Home?

Can My Children Keep my Home?

Yes. One of the benefits of HECM loans is that your heirs are provided the option to get alternative financing, pay off the reverse mortgage, and keep the house. However, the money to repay the HECM loan most often comes from the sale of the home itself after the house passes to your children.

In the rare event that the amount of the reverse mortgage repayment is more than the house is worth, neither your heirs nor you will be obligated to repay the difference. Insurance from the FHA is a part of every Home Equity Conversion Mortgage, so that would make up for any shortfall.

Can I Get Rid of Monthly Mortgage Payments?

Can I Get Rid of Monthly Mortgage Payments?

Yes. If there’s a typical mortgage on your home, the cash from the HECM loan is initially used to pay off that loan. Since no monthly mortgage payments are needed on the HECM1, you can eliminate that monthly bill and keep more money to use as you see fit.

One of the biggest benefits of how HECM loans work is that repayment is delayed. This means that repayment of the loan is not due until after the final borrower no longer resides within the home. The choice is yours on whether or not you would like to pay off the HECM in advance. There are no prepayment penalties with your reverse mortgage. And with optional mortgage payments1, you can enjoy the freedom to pay as much or as little as you want, as often as you’d like.

How Much Cash Can I Get with a HECM Loan?

How Much Cash Can I Get with a HECM Loan?

There are many elements that go into determining how much of your house’s equity you can convert to cash with a reverse mortgage. Your home's appraised value, age, and current interest rates are all taken into consideration. Often, the amount of money you can qualify for will be between 50% and 70% of your home’s value. Contact me to get your free, no-obligation, personalized quote.