Per the Federal Trade Commission (FTC), HECM loans work by letting homeowners turn part of their house's equity into cash without having to sell their home or make regular monthly mortgage payments1.

Unlike a standard forward mortgage, where the homeowner begins paying down the mortgage immediately, homeowners do not have to repay money collected through a HECM until after the last borrower no longer lives in the house2. Monthly mortgage payments are not required1.

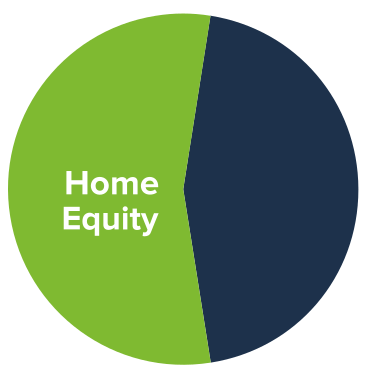

For most seniors in Sacramento, their house is their most important asset, and the one they have invested the most in throughout their lives. In fact, equity in homes now represents more than two-thirds of total net worth for the average 65-year-old couple in America3.

HECM loans work by letting homeowners access their home’s equity while still residing in their house well into their retirement years. Over 1.2 million Americans have already made a HECM loan part of their retirement plan4.

Reverse vs. Traditional Mortgage

Reverse vs. Traditional Mortgage

When it comes to traditional and reverse mortgages, there are several similarities and differences. While traditional mortgages require homeowners to make regular payments on their loan balance every month for several years, reverse mortgages do not require borrowers to make any monthly mortgage payments1.

Similarities:

- The homeowner retains deed and ownership of the home.

- The owner is responsible for insurance, maintenance, and property taxes.

- Both mortgages are secured by notes and deeds.

- Closing costs for a reverse mortgage are similar to those for a classic (forward) mortgage.

Differences:

- HECM loans do not require monthly mortgage payments to be made1.

- The credit line for a HECM loan will never be lowered; it is guaranteed to increase over time, regardless of loan balance or home value.

- The borrower will never be required to repay more than the home is worth (non-recourse loan) and they pay a modest FHA insurance premium for this protection.

- Borrowers are required to be at least 62 years old to apply for a Home Equity Conversion Mortgage.

According to the Federal Housing Administration (FHA) rules, there are more guidelines as to how a reverse mortgage works.

Homeowners are required to use the house as their main residence while keeping the house in good condition. Borrowers receiving a Home Equity Conversion Mortgage are also required to partake in third-party FHA-approved counseling before the closing of the loan.

How Can HECM Funds Be Used?

How Can HECM Funds Be Used?

The funds you get from a reverse mortgage can be utilized in any way you want. There are several methods of receiving your money and how you decide to use this money depends entirely on your retirement goals and personal financial situation. If there is a current mortgage on the Sacramento home, the cash from the reverse mortgage is first used to repay the balance. The remaining money can then be taken in any of the following ways:

- A one-time payment, income tax-free.5

- Consistent, tax-free monthly payments.5

- A credit line, as a “safety net” for future use when or if you need it.

- Any combination of these methods.

Each homeowner is different, and our customers have found creative ways to use a HECM loan to improve their incomes, lifestyles, and monthly cash flow. These are a few quick examples of how reverse mortgages can work to your advantage:

- Have a line of credit for occasional expenses or emergencies.

- Set aside cash to assist in paying for long-term care in the years ahead.

- Support a family member with large expenses, such as a down payment on a home or college tuition.

- Keep more funds on hand to pay for everyday expenses and bills.

- Reduce or eliminate debt or credit card balances.

- Assist with medical bills, making "aging in place" easier.

- Make updates, repairs, or modifications to your house to live more comfortably.

- Decrease your total taxable income: avoid making taxable withdrawals from 401(k) or other retirement plans by replacing the money with income tax-free reverse mortgage funds5.

Can My Children Keep my House?

Can My Children Keep my House?

Yes. One of the positives of Home Equity Conversion Mortgages is that your heirs have the option to get their own financing, repay the reverse mortgage, and keep the house. However, the funds to pay off the reverse mortgage usually come from the sale of the house itself, after the home passes to your heirs.

In the rare event that the total amount of the HECM loan repayment is more than the house is worth, neither your heirs nor you will be responsible for repaying the difference. FHA insurance is a part of every Home Equity Conversion Mortgage, so that would cover any shortfall.

Can I Eliminate Monthly Mortgage Payments?

Can I Eliminate Monthly Mortgage Payments?

Yes. If you have a conventional mortgage on your house, the money from the Home Equity Conversion Mortgage is first used to repay that loan. Since no monthly mortgage payments are required on the HECM1, you'll be able to get rid of that monthly expense and keep more cash to use as you desire.

One of the main benefits of reverse mortgages is that repayment is deferred. This means that the loan repayment is not due until after the final borrower no longer lives in the home. The choice is yours on whether or not you would like to repay the reverse mortgage ahead of time. You will have no early payment penalties with the Home Equity Conversion Mortgage. And with voluntary mortgage payments1, you have the flexibility to pay as little or as much as you would like, as often as you would like.

How Much Money Can I Receive from a Reverse Mortgage?

How Much Money Can I Receive from a Reverse Mortgage?

There are many elements that go into determining how much of your house’s equity you can convert to cash with a reverse mortgage. Your home's appraised value, age, and current interest rates are all taken into consideration. Often, the amount of money you can qualify for will be between 50% and 70% of your home’s value. Contact me to get your free, no-obligation, personalized quote.