Per the Federal Trade Commission (FTC), HECM loans work by allowing homeowners to turn part of their home’s equity into cash without having to sell the home or make regular monthly payments1.

Unlike your traditional forward mortgage, where the borrower must begin paying down the mortgage immediately, homeowners do not have to pay off money received through a reverse mortgage until after the final borrower stops living in the home2. Monthly loan payments are not required1.

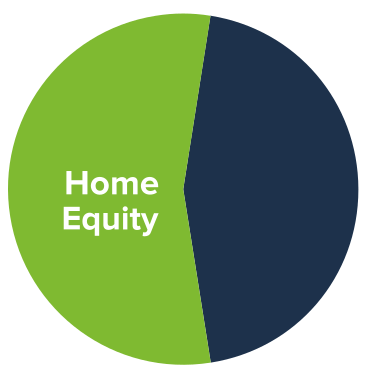

For most seniors in Las Vegas, their house is their largest asset, and the one they have invested the most in during their lives. In fact, equity in homes now represents more than two-thirds of all net worth for an average retired couple in America3.

HECM loans work by letting homeowners access their home’s equity while still residing in the home well into their retirement years. More than 1.2 million American seniors have already made a reverse mortgage a powerful part of their retirement plan4.

Reverse vs. Forward Mortgage

Reverse vs. Forward Mortgage

When comparing traditional and reverse mortgages, you'll find several similarities and differences. While traditional mortgages require homeowners to make scheduled payments towards the mortgage balance every month for several years, reverse mortgages do not require homeowners to make any monthly loan payments1.

Similarities:

- The owner maintains title and ownership of the home.

- The owner is responsible for insurance, property taxes, and maintenance.

- Both mortgages are secured by notes and deeds.

- Closing costs for a reverse mortgage are similar to those for a typical (forward) mortgage.

Differences:

- Your credit line for a HECM loan can never be reduced; it's guaranteed to increase over the life of the loan, regardless of the balance or your home's value.

- HECM loans do not require monthly loan payments to be made1.

- Borrowers will never be required to pay back more than their home is worth (non-recourse loan) and they pay a modest FHA insurance premium for these benefits.

- Borrowers are required to be at least 62 years old in order to qualify for a reverse mortgage.

According to the Federal Housing Authority (FHA) rules, there are a few other factors regarding how a HECM loan works.

Borrowers must use the house as their primary residence while keeping the house in satisfactory condition. Homeowners taking out a HECM loan must also receive independent FHA-approved counseling as part of the process.

How Can HECM Cash Be Used?

How Can HECM Cash Be Used?

The money you get from a reverse mortgage can be utilized in any way you want. There are many methods for receiving funds and how you decide to use these proceeds depends entirely on your personal financial situation and retirement goals. If there is an existing mortgage on the house in Las Vegas, the proceeds from the reverse mortgage are first used to pay off the loan. The remaining money can be received in any of the following distribution methods:

- A one-time payment, income tax-free.5

- Steady, tax-free monthly payments.5

- A credit line, as a “safety net” for later use if needed.

- A combination of these.

Every homeowner is unique, and our customers have discovered creative ways to use a Home Equity Conversion Mortgage to improve their lifestyles, incomes, and monthly cash flow. Here are just a few examples of how Home Equity Conversion Mortgages can work to your advantage:

- Make modifications, improvements, or repairs to your house to live more comfortably.

- Lower your taxable income: prevent having to make taxable withdrawals from IRA, 401(k), or other retirement plans by replacing the funds with income tax-free HECM funds5.

- Have extra funds available to cover everyday expenses and bills.

- Eliminate or reduce debt or credit card balances.

- Assist with healthcare bills, making it easier to “age in place.”

- Set aside funds to assist in paying for long-term care in the future.

- Establish a line of credit for emergencies or occasional expenses.

- Support a child or grandchild with life expenses, such as college tuition or a down payment on a home.

Can My Children Keep the Home?

Can My Children Keep the Home?

Yes. One of the positives of Home Equity Conversion Mortgages is that your heirs have the option to get alternative financing, repay the loan, and keep the Las Vegas home. However, the funds to pay off the reverse mortgage usually come from the sale of the home itself, after the home passes to your children.

In the rare event that the amount of the loan repayment is more than the home is worth, neither your heirs nor you will be obligated to repay the difference. Insurance from the FHA is a component of every Home Equity Conversion Mortgage, so it would cover any shortfall.

Can I Get Rid of Monthly Mortgage Payments?

Can I Get Rid of Monthly Mortgage Payments?

Yes. If there’s a traditional mortgage on your home, the cash from the HECM loan is initially used to repay that loan. Since no monthly mortgage payments are needed on the HECM1, you'll be able to get rid of that monthly bill and keep more income to use as you see fit.

One of the largest benefits of HECM loans is that repayment is deferred. This means that repayment of the loan is not due until after the final borrower no longer resides within the home. The decision is yours as to whether or not you would like to pay off the reverse mortgage in advance. You will have no prepayment penalties with a Home Equity Conversion Mortgage. And with optional mortgage payments1, you have the flexibility to pay as little or as much as you would like, as regularly as you’d like.

How Much Cash Can I Get with a Reverse Mortgage?

How Much Cash Can I Get with a Reverse Mortgage?

There are many elements that go into determining how much of your house’s equity you can convert to cash with a reverse mortgage. Your home's appraised value, age, and current interest rates are all taken into consideration. Often, the amount of money you can qualify for will be between 50% and 70% of your home’s value. Contact me to get your free, no-obligation, personalized quote.